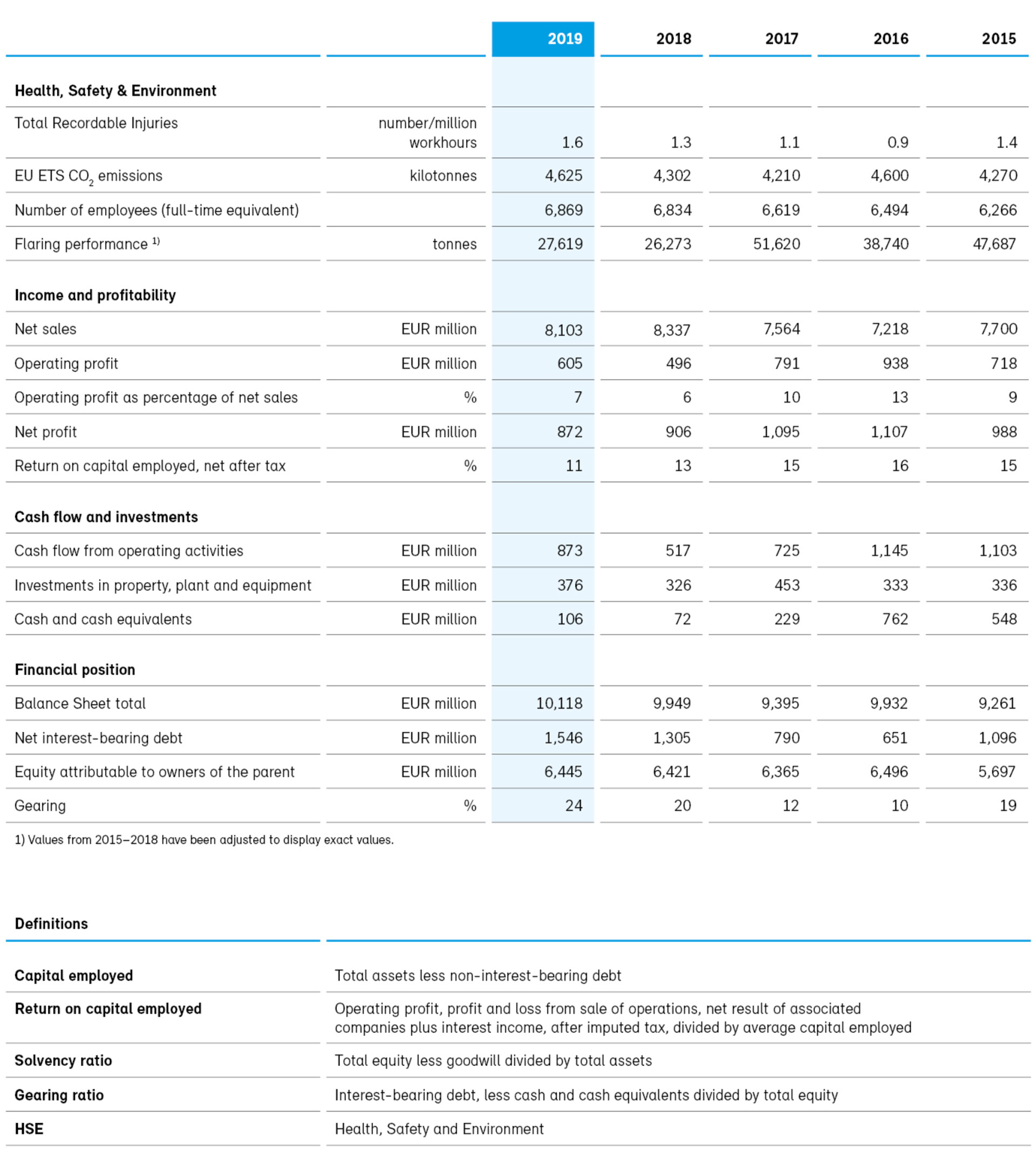

In 2019, Borealis reported a Total Recordable Injuries (TRI) frequency per million working hours of 1.6. While a TRI frequency of less than two is considered world-class in the industry, the 2019 result is not satisfactory, and is a deterioration versus the 1.3 reported in 2018. The ratio reflects the 28 individuals injured during 2019 as well as one fatal accident in Stenungsund, Sweden. Borealis deeply regrets this tragic accident and all other incidents. The company has strengthened its commitment to working with all employees and contractors in order to reach the ultimate goal of zero injuries. Safety continues to be the top priority at Borealis.

The Brent Crude oil price was impacted in 2019 by increasing global instability rooted in the China-US trade conflict, uncertainty with regard to Brexit, and concerns over a general economic slowdown. Accordingly, the oil price was marked by higher volatility, fluctuating throughout 2019 from 60 USD/bbl at the beginning of the year, to a peak of 72 USD/bbl in April, and ending at 65 USD/bbl in December. The annual average Brent Crude oil price of 64 USD/bbl was down 11% from the average 72 USD/bbl in 2018. Feedstock prices developed in a similar pattern as the Brent Crude oil price. In accordance with feedstock prices, polyethylene prices averaged 9% lower compared to 2018; polypropylene prices averaged 8% lower in 2019 than in 2018.

Borealis’ sales volume of its European-produced polyolefins was stable in 2019, while the European-produced polyolefins market contracted by 1% compared to 2018.

Thus, Borealis’ reported market share of 14% in 2018 improved to 15% in 2019. Fertilizer sales volumes increased by 10% in 2019 compared to 2018 and the European market share increased to 8% in 2019 accordingly.

In 2019, the integrated polyolefin industry margins remained solid for the first three quarters of the year. However, the margin contracted in the last quarter of the year to a level last seen in 2014. Consequently, the profit contribution delivered from the Polyolefins business segment was lower than in 2018.

As of the second quarter 2019, the fertilizers market benefitted from a favourable gas price development, leading to a reasonable industry margin despite the absence of the expected market price recovery. Calcium Ammonium Nitrate (CAN) fertilizer sales prices hit a low in the second quarter of 2019, in line with typical seasonality, but failed to recover from this low level as would be expected in a typical fertilizer season. Higher production volumes thanks to the improved operability of the assets, and a successful turnaround programme in combination with the improved market environment led to an acceptable profit contribution in 2019 being a material improvement from the loss – giving situation in 2018.

In the first quarter of 2020, Borealis will begin with the roll-out of the new corporate strategy that includes an expanded definition of purpose. The new Group Strategy 2035 aims to build on core Borealis values and capabilities in order to achieve sustainable growth moving forward. The essential dimensions of the new strategy include the transformation to a circular economy, creation of an even more customer-centric organisation that adds value on a global scale, and geographic expansion aimed at capitalising on demand in global growth markets.

Accompanying the Group Strategy 2035 is a new umbrella programme, StepChange2020, which encompasses an entire range of measures aimed at making Borealis more agile, efficient, and cost-competitive. To this end, around 180 initiatives have been launched to ensure that Borealis will continue to be innovative, profitable, and ever more sustainable in its operations over the coming years.

In 2019, Borealis passed several major milestones in the advancement of significant growth projects in Europe, North America, Asia, and the Middle East.

In September, Borealis held the groundbreaking ceremony for its new, world-scale propane dehydrogenation (PDH) plant located at the existing Borealis production site in Kallo, Belgium. With a targeted production capacity of 750,000 metric tonnes/year (t/y) of propylene, the Kallo facility will be one of the largest and most efficient plants of its kind in the world. The EUR 1 billion investment over the course of this project is the largest single investment ever made by Borealis in Europe. It signals the company’s dedication to its operations on the Continent, and its aim to be the supplier of choice to its European customers.

Another important groundbreaking ceremony took place in February 2019 in Pasadena, Texas (USA), where a new Borstar polyethylene (PE) unit is currently under construction as part of the Baystar joint venture between Total Petrochemicals & Refining USA, Inc., and Novealis Holdings LLC (a joint venture co-owned by Borealis and NOVA Chemicals). With an anticipated production volume of 625,000 t/y upon start-up in 2021, the facility will enable Borealis to offer its Borstar technology to North American customers for the first time. Using this proprietary, state of-the-art technology, Baystar will produce enhanced PE products for the most demanding applications. The Baystar joint venture is also building an ethane-based steam cracker in nearby Port Arthur, Texas, which is projected to supply around 1 million t/y of competitively-priced ethylene, and will supply its monomer for its existing 400,000 t/y PE units as well as the new Borstar PE unit.

At the end of 2019, Borealis and NOVA Chemicals agreed that Borealis will buy NOVA Chemicals’ 50% ownership interest in Novealis Holdings LLC, the joint venture co-owned by Borealis and NOVA Chemicals which supported the original foundation of the current Baystar joint venture. While the new agreement is subject to regulatory approvals and other conditions, both parties foresee the successful closure of the deal in the first half of 2020.

Borealis’ commitment to serving its automotive customers in North America was cemented with the inauguration of the new polypropylene (PP) compounding plant in Taylorsville, North Carolina (USA), in May. In its first phase of operations, this large (over 4,645 m2) facility has added nearly 30,000 t/y (66,000 US lbs per year) capacity of thermoplastic olefin and short-glass fibre compounds to Borealis’ and Borouge’s global output. The first batches of compounds produced at the plant have been used by major original equipment manufacturers and Tier customers to produce interior and exterior automotive parts.

Following the March 2019 signing of a Memorandum of Understanding (MoU) with ADNOC to examine strategic opportunities in the polyolefins industry, ADNOC, Adani, BASF and Borealis announced that they had signed another MoU to explore potential collaboration on the establishment of a major chemical production complex in Mundra, India. With a total investment estimated at up to USD 4 billion, the chemical complex would feature a world-scale PDH unit which would produce propylene based on propane feedstock supplied by ADNOC. Project partners are currently developing a supply concept that would enable the complex to be 100% supplied by renewable energy sources. If the concept can be realised, the new plant would be the first in the world to be powered solely by renewable energy and would significantly advance the companies’ respective commitments to achieving greater sustainability and energy efficiency in operations.

A major milestone was passed in the fourth expansion phase of the Borouge complex in Ruwais, UAE, upon the ceremonial signing of vital contracts for FEED (Front- End Engineering and Design), PMC (Project Management Contract), and the licence contract associated with the cracker. The new cracker will be the fourth in the Borouge complex.

As a global provider of innovative plastics solutions, Borealis intends to capitalise on the enormous potential for business growth offered by the circular economy. Within the industry, Borealis continues to lead the way towards a future in which plastics are always reused and recycled, and never wasted. By leveraging the polyolefins expertise built up over decades, creating value through innovation, and co-operating with value chain partners, Borealis has made meaningful progress in 2019 towards effecting a circular economy of plastics. Its efforts are wide-ranging, from the launch of multiple products and innovations in the circular economy sphere, to investments in mechanical and chemical plastics recycling, but also through its dedication to effecting change by working closely with leading industry and social welfare initiatives.

A clear sign that Borealis’ leadership in a circular economy of plastics is bearing fruit is the announcement made in October that Borealis had become the first virgin polyolefins producer to be named a Core Partner in the New Plastics Economy, an important global initiative led by the Ellen MacArthur Foundation that seeks to unite a broad range of global stakeholders to bring about a circular economy of plastics.

Borealis is making its core business more circular by focussing on recycling and the use of renewable feedstock. It aims to increase the volume of recycled plastics solutions to 350,000 t/y by 2025 by continuing to invest in plants and recycling technology. For example, in October Borealis and Ecoplast announced that the capacity at the Wildon, Austria, recycling plant had been increased by 60% after a capital investment in the facility. In June, Borealis and the EREMA Group, the global market leader in the development and production of plastics recycling systems, signed a Letter of Intent signalling their aim to deepen their existing co-operation in mechanical recycling. In the field of chemical recycling, Borealis and OMV announced their plans in May to step up collaboration in the area of chemical recycling of post-consumer plastics at their integrated production location in Schwechat, Austria. Most recently, as announced towards the end of 2019, a strategic co-operation between Borealis and Neste made possible the production of renewable PP at Borealis’ facilities in Kallo and Beringen, Belgium, through the use of Neste’s proprietary NEXBTL technology.

Borealis’ commitment to Value Creation through Innovation is unwavering. Because it applies not only to individual products and solutions, but also to the polyolefins value chain in its entirety, it involves truly circular thinking. Value Creation through Innovation embraces the entire life cycle of a product: from genesis, to design, processing, deployment, and ultimate recovery for recycling or reuse.

Over 500 employees work in R&D at the Borealis Group. This figure includes scientists and researchers at the Innovation Headquarters in Linz, Austria, and the two Innovation Centres in Stenungsund, Sweden, and Porvoo, Finland.

Among the numerous circular-economy related launches in 2019 is Borcycle™, a state-of-the-art technology grounded in profound Borealis polymer expertise. It transforms plastic waste streams into value-adding, versatile recycled polyolefins (rPO). Since its introduction in June, Borcycle has been used to produce high-quality compounds made of rPOs, such as Borcycle MF1981SY, an rPO with over 80% recycled content intended for use in visible appliance parts.

A number of value-added product innovations with enhanced circularity were launched in 2019, including a series of new, monomaterial pouch solutions based on PE and PP which have been designed for recyclability; and two new stand-up pouches that combine virgin PE and up to 30% Ecoplast-produced post-consumer recyclate (PCR). In the caps and closures market segment, the new monomaterial solution BorPure™ RF777MO was designed for use in flip-top caps and fulfils value chain demand for high-quality and 100%-recyclable solutions. Finally, in automotive, new and more sustainable low-density material solutions have been introduced, several of which are based on the next generation of Fibremod Carbon, a second-use carbon fibre.

In February, Borealis Healthcare expanded its dedicated Bormed™ portfolio of PE and PP products to include the regulated solution Bormed BJ868MO, a high flow, heterophasic polypropylene copolymer used for the production of medical and diagnostic devices. In November, it also announced the launch of a new service solution, Bormed InCompounds. This offer enables the customisation of compounds based on Bormed for use in an even wider range of targeted healthcare applications and products. It builds on value-chain co-operation with trusted and established partners in healthcare compounding.

With a net profit of EUR 872 million, Borealis achieved a strong financial result in more difficult market circumstances, only slightly below the net profit of EUR 906 million in 2018. The 2019 result was impacted by a weak polyolefins market in Asia, leading to a significantly lower Borouge contribution to the Borealis financial result. The satisfactory integrated polyolefins margins in Europe and a recovery of the fertilizer business have offset this negative impact to a large degree.

Return on capital employed (ROCE) after tax of 11% in 2019 was in line with the Company’s target of 11% through the cycle, but was 2 percentage points below the 2018 result. This decrease reflects the lower net profit combined with an increased average capital employed, the latter mainly impacted by the new accounting treatment of leasing contracts under International Financial Reporting Standard (IFRS) 16, as well as substantial capital investments in growth projects.

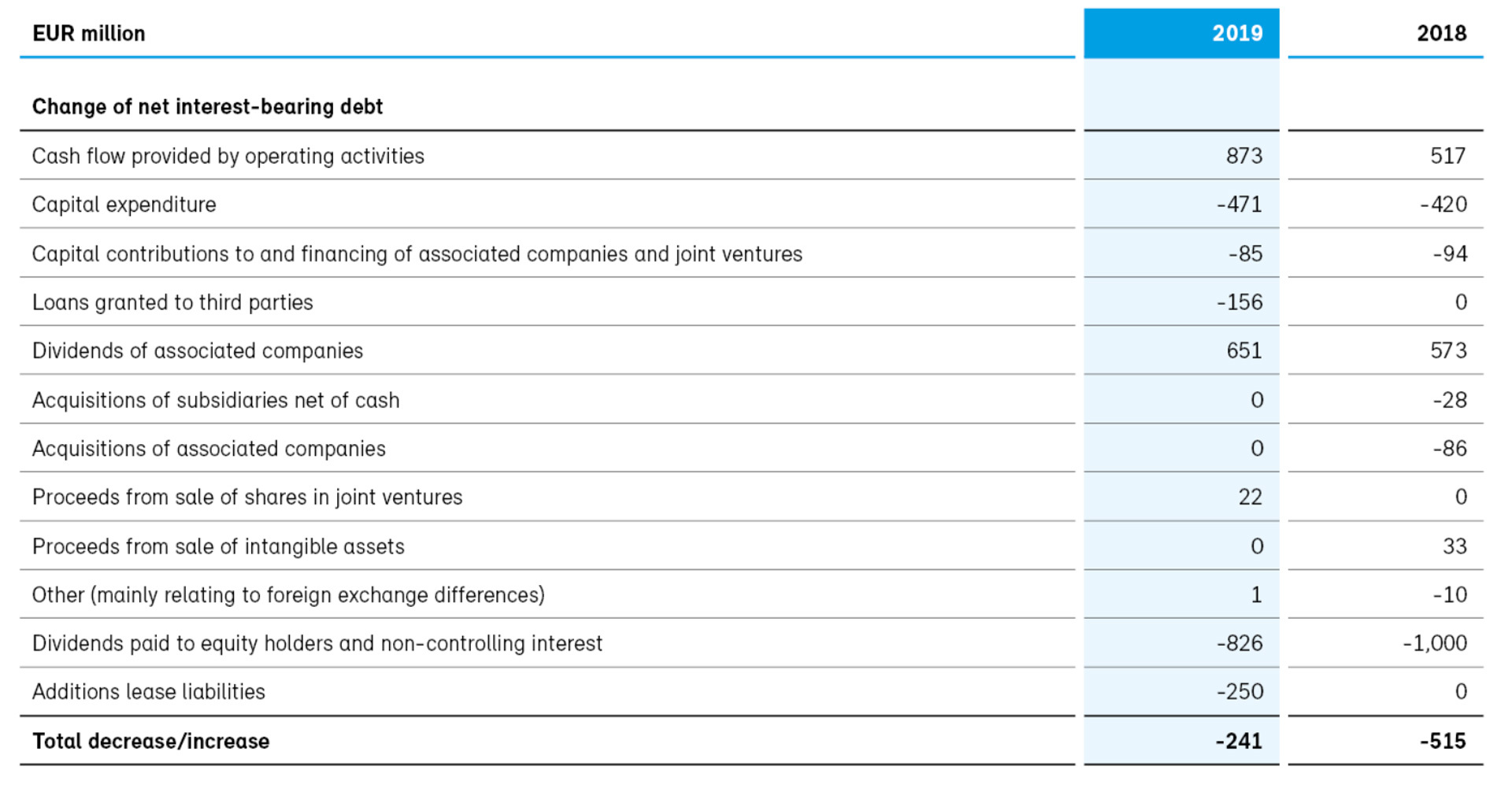

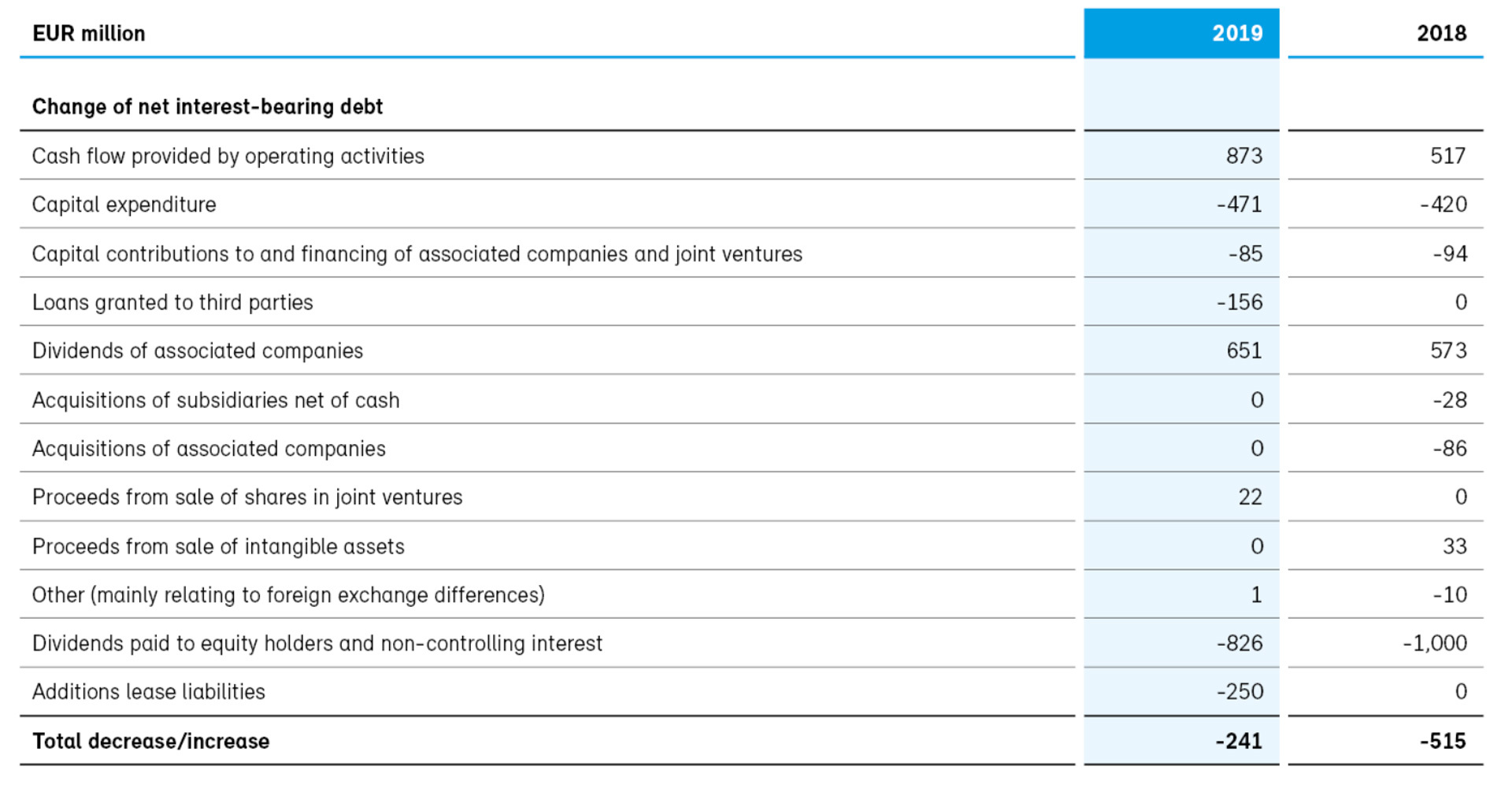

In 2019, Borealis’ net debt increased by EUR 241 million. This resulted in a gearing ratio of 24% at the end of 2019, compared to 20% at the end of 2018. This gearing level is below the target gearing of 40%–60%. Borealis benefits from a well-diversified financing portfolio and a balanced maturity profile, which was further developed in May with the placement of another Schuldschein (German Private Placement) with a final volume of EUR 140 million and USD 70 million. In October, an inaugural dual currency “Samurai” loan was placed, with a final volume of USD 175 million and JPY 5,000 million, which in total amounts to approximately EUR 200 million equivalent and a tenor of five years. In December, a US private placement was successfully closed, covering 10-, 12-, and 15-year tenors for USD 165 million as well as 10- and 15-year tenors for EUR 40 million.

Borealis sold 3.8 million tonnes of polyolefins in 2019, which is at the level of 2018. Borealis Fertilizers sales reached 4.3 million tonnes, an increase of 0.3 million tonnes versus 2018. Melamine sales volumes were 146 thousand tonnes in 2019, an increase of 11 thousand tonnes versus 2018.

In the lower feedstock price environment, production costs decreased in 2019 compared to 2018. Sales and distribution costs increased from EUR 704 million in 2018 to EUR 717 million in 2019; administration costs increased by 10% to EUR 249 million. Research and development costs amounted to EUR 145 million in 2019 compared to EUR 128 million in 2018. The number of full-time equivalent employees (FTE) as per year-end 2019 was 6,869, an increase of 35 compared to last year.

Operating profit amounted to EUR 605 million compared to EUR 496 million in 2018. The increase is thanks to a recovery of the Fertilizer business within the fertilizer, melamine and technical nitrogen unit and due to a strong result in the Base Chemicals business segment compared to 2018, which was partially offset by a weaker polyolefins contribution.

The return on capital employed after tax decreased to 11%, compared to 13% in 2018, mainly as a result of the reduced net profit, the higher CAPEX spent for the Growth projects as well as applying the new accounting Standard for lease contracts (IFRS 16).

Net financial expenses amounted to EUR 36 million, an increase from EUR 31 million in 2018, due to an increased debt position, unfavourable exchange rate effects and the application of the new leasing Standard (IFRS 16).

Income taxes amounted to EUR 82 million, a decrease of EUR 82 million from tax charges of EUR 164 million in 2018. The reduced overall tax charge in 2019 was mainly due to the agreement reached between the Finnish and Austrian tax authorities on two cases regarding the taxation of Borealis’ Finnish subsidiaries Borealis Technology Oy and Borealis Polymers Oy. The dispute was resolved through a Mutual Agreement Procedure (MAP) between Finland and Austria which finally eliminates double taxation. Borealis paid income taxes of EUR 225 million in 2019, compared with EUR 154 million in 2018.

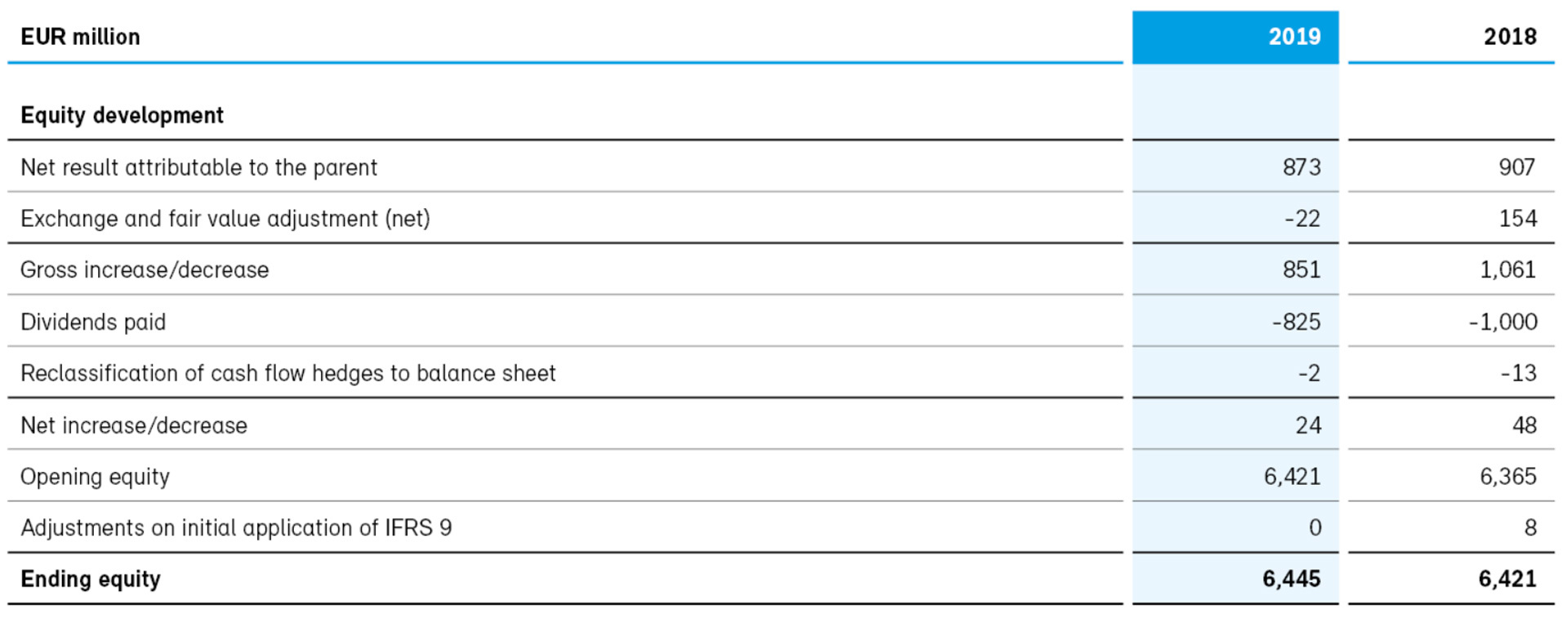

The net profit for the year amounted to EUR 872 million, compared to a net profit of EUR 906 million in 2018. During 2019, Borealis distributed a dividend of EUR 825 million to its shareholders, EUR 525 million for 2018 and EUR 300 million as interim dividend for 2019.

At year-end, total assets and capital employed stood at EUR 10,118 million and EUR 8,110 million, respectively, compared to EUR 9,949 million and EUR 7,814 million at the end of 2018.

The solvency ratio was 63% at year-end 2019, compared to 64% at year-end 2018. The gearing ratio increased to 24% at year-end 2019, compared to 20% in 2018, as a result of the increased net debt not fully compensated by an increased total equity.

Cash flow from operations was EUR 873 million, driven by solid operating profitability. Liquidity reserves, composed of undrawn, long-term committed credit facilities and cash balances, amounted to EUR 1,214 million at year-end 2019, compared to EUR 1,072 million at year-end 2018. Net interest-bearing debt increased to EUR 1,546 million at year-end, up from EUR 1,305 million at the end of 2018. The change in net interest-bearing debt is analysed in the following table.

Investments in property, plant and equipment amounted to EUR 376 million in 2019, compared to EUR 326 million in 2018. The largest portion of the total investment relates to the new, world-scale propane dehydrogenation (PDH) plant in Kallo, Belgium, the upgrade and revamp of four cracker furnaces in Stenungsund, Sweden, the debottlenecking of a PP-plant in Kallo, Belgium, and an investment into a new Naphtha cavern in Porvoo, Finland. Health, Safety and Environment (HSE) capital expenditure amounted to EUR 43 million, compared to EUR 34 million in 2018. Depreciation and amortisation amounted to EUR 427 million, compared to EUR 457 million in 2018.

The shareholders’ equity at year-end 2019 was EUR 6,445 million.

Borealis has a documented risk management process ensuring that all parts of the Group routinely identify and assess their risks, and develop and implement appropriate mitigation actions. Risk management contributes to achieving the Company’s long-term strategies and short-term goals. Borealis believes that an effective risk culture makes it harder for an outlier, be it an event or an offender, to put the Company at risk.

The Company’s overall risk landscape is periodically consolidated, reported and reviewed. While the risks discussed below exemplify the Company’s risks, the list is not exhaustive. Borealis distinguishes between the following risk categories. Strategic & reputational risks are those that may severely impact Borealis’ strategy or reputation. Often, strategic risks are related to unfavourable long-term developments, such as market or industry developments, technology, innovation, a change in the competitive environment, or a threat to the reputation of the Group.

Operational & tactical risks usually refer to unfavourable and unexpected short-term or mid-term developments, and include all risks that may have a direct impact on the Group’s daily business operations. All operational risks are assessed according to documented guidelines and procedures that are administered by the respective business functions. A pro-active risk prevention management approach has been implemented in the Operations function, covering risks in the areas of Production, Health, Safety and Environment (HSE), Product Stewardship, Plant Availability and Quality. The risk management approach also safeguards the Responsible Care approach towards risks in Operations. The standard risk management process includes a common risk matrix and risk registers, built bottom-up from plant level up to portfolio level, enabling a common risk rating system for the whole of Operations.

HSE risks are assessed according to the procedures and framework described in the Borealis Risk-based Inspection Manual. The Director HSE is responsible for managing all HSE-related risks and reports the Borealis HSE risk landscape to the Executive Board periodically.

Project-related risks are assessed in the Borealis project approval process. The applicable key risks related to an individual project are assessed. These include financial, market, technical, legal, patent infringement, strategic, operational, country-related, and political factors. The risk assessment also reflects the probability of project completion within the estimated time frame and forecasted resource requirements, and the likelihood that key project objectives will be achieved. Project-related risks are managed by the Project Manager and reported to the Project Steering Committee.

Financial & market risks may refer to risks arising from unexpected changes in market supply, demand, price of commodity, services or financing costs, for instance. Risks arise from liquidity, interest rates, foreign exchange rates, credit, commodity prices, and insurance, the inability of a counterparty to meet a payment or delivery commitment but also extend to incorrect assumptions or the inappropriate application of a model, for instance. The assessment of financial risk management is described in detail in note 17 of the consolidated financial statements. The Director Treasury & Funding and the General Counsel shall be responsible for reporting and coordinating the management of all financial risks.

Compliance Risks focus on legal and regulatory risks, code of conduct (ethics policy), standards as well as contracting compliance. Doing business in an ethical manner is vital to Borealis’ good reputation and continued success. Tactical or generic risks are risks identified as part of standards or compliance. These risks relate mainly to processes or control weaknesses.

Information security risks relate to the confidentiality, integrity and availability of critical company information. The Director IT and the General Counsel support line managers with the assessment of information security risk, and the development and implementation of risk mitigation actions.

The Executive Board periodically reviews the Group’s key risks, defines the Group’s risk tolerance levels, monitors the implementation of mitigation actions, and reports the key risks and mitigation steps to the Supervisory Board. The Executive Board safeguards the integration of risk assessment in its strategic planning.

The Supervisory Board is responsible for reviewing the effectiveness of Borealis’ risk management practices and processes, risk appetite / tolerance levels, risk exposure of the Group, and the effectiveness of mitigation actions. The Supervisory Board delegates some of these responsibilities to the Audit Committee, which is a sub-committee of the Supervisory Board.

All Borealis employees are responsible for managing risk, within their authority and in their field of work, in order to ensure that risk management is properly embedded in the organisation and reflected in the daily decision-making processes.

In 2019, Borealis extended its initial ambition under the Borealis Energy Roadmap 2020 to improve energy efficiency by 10% (equivalent to 2,400 GWh) in 2020 versus the reference year 2015. The enhanced target is to double the energy efficiency reduction by 2030, meaning an increase in energy efficiency by 20% by 2030.

Having implemented ISO 50001 in 2018, Borealis will use this international energy management Standard as the foundation for achieving its energy efficiency targets. Borealis will therefore implement tools to operate its plants in the most efficient way, continuously optimise plant design and monitoring, and implement new technologies to optimise energy efficiency. Furthermore, industrial clusters will be used to seek further energy integration.

Effective as of 3 July 2019, Thomas Gangl, member of the Executive Board at OMV, was appointed Supervisory Board member, succeeding Manfred Leitner.

The Borealis People Survey is a very important instrument for enabling employee feedback. Among other things, it measures levels of employee engagement, and compares these to other companies in the chemical sector and beyond. The response rate to the 2019 survey, which was sent to employees in the fall of 2019, was 85%. This rate is excellent and a slight improvement over the previous survey cycle. The results will be reviewed in detail and translated into tangible “People Actions” in the first quarter of 2020.

Management expects that the weaker market environment will last into 2020. Building on the strong foundation established over recent years, an improved operational reliability, and its well-established commercial excellence mind-set, Borealis will implement the new Group Strategy 2035, which will further improve the long-term competitiveness and the growth of the Company. With European polyolefin prices coming under pressure, a declining contribution from the Polyolefins business is expected, while the profit contribution from Borouge to Borealis is expected to remain at the same level as in 2019. In the fertilizer segment, a continuation of the recovery of the market environment in 2020 is expected. Borealis’ management believes that the Company is in a strong position to take advantage of the opportunities that the current economic and market environments provide by maintaining their commitment to being the leading provider of sustainable chemical and innovative plastic solutions that create value for society.

In accordance with section 267a (6) of the Austrian Commercial Code (“UGB”), Borealis prepares a separate consolidated non-financial report.